Community Banks

Community and local banks serve millions, often in regions overlooked by national chains. This critical mission brings real security challenges.

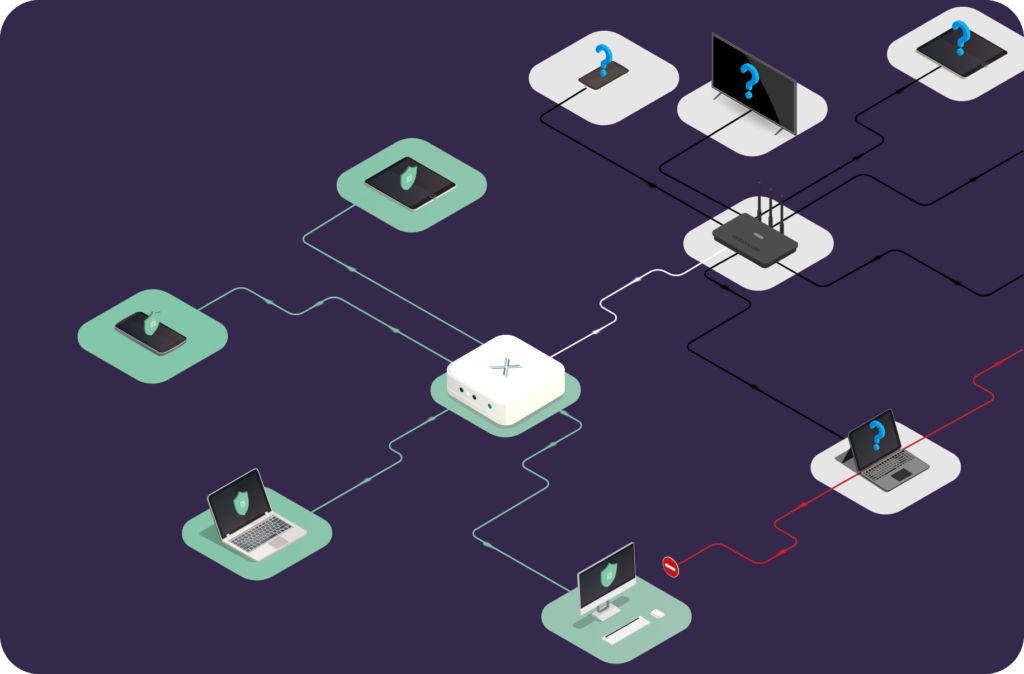

As banking operations increasingly rely on remote access and distributed teams, smaller institutions face significant exposure at the uncontrolled network edge: staff homes, legacy branch networks, leased offices, and off-site operations.

These environments typically fall outside direct IT oversight yet maintain connectivity to core banking systems and sensitive customer data. Threat actors recognize these vulnerabilities and are targeting them with greater speed and scale.

Loxada provides a simple, secure, and regulator-aligned way to protect remote access and sensitive systems, even for banks without large IT teams or specialist infrastructure.

Why Local Banks Are Under Pressure

The threat landscape has shifted, and not in favour of small banks.

- Consumer-grade and legacy routers are being scanned and exploited in increasing numbers

- Attack kits and AI tools are lowering the barrier to entry for cybercrime

- Remote access for staff is now a permanent feature of banking operations

- Regulatory expectations around patching, firmware integrity, and remote access are rising

Where large banks operate with dedicated security operations centers and in-house engineering teams, local and community banks often rely on ‘doing more with less’ and smaller support teams. Adversaries are fully aware of this disparity.

What Is the Uncontrolled Network Edge?

The network edge used to mean a physical branch or data centre. Today, it’s anywhere a banking employee connects to systems or data, often from locations that IT can’t fully manage or secure.

This includes:

- Home environments with outdated or ISP-supplied routers

- Leased or shared office space with unknown infrastructure

- Mobile or hybrid setups for loan officers, auditors, or contractors

These scenarios all introduce unmonitored network entry points, and most banks have no practical way to secure them.

Typical Risks We Help Solve

- A back-office processor working from home on a misconfigured router

- An internal audit team using a coworking space to review secure documents

- Branch locations using the same networking gear for over a decade

- Compliance officers accessing internal systems from hotel or airport Wi-Fi

- Customer service reps connecting from shared home networks

Each of these scenarios creates an opening for malware, lateral threats, or unauthorised access, potentially violating FDIC cyber expectations and internal controls.

How Loxada Works

Each Loxada device arrives with our proprietary secure firmware already installed, no trace of consumer software or insecure features. Once powered on, the device:

- Creates a dedicated, encrypted work-only network

- Routes traffic through an always-on secure VPN

- Receives automatic firmware and security updates

- Blocks risky or malicious traffic by default

- Connects only to authorised Loxada-managed endpoints

There’s no configuration needed, no risk of tampering, and no reliance on staff to maintain updates or settings.

Compatible with Existing Security Infrastructure

Loxada is designed to complement, not replace, your existing security stack.

- Works alongside VPNs, remote desktops, and identity tools

- Can be deployed at staff homes, temporary offices, or branch sites

- Requires no local IT support; all devices are plug-and-play

- Prevents risky local devices from accessing corporate systems by network separation

It creates a known, trusted network that’s distinct from the home or office environment it’s running in, giving your team full confidence in the connection, even if the surrounding network is compromised.

Regulatory Guidance Is Getting Clearer

The FDIC, OCC, and state banking regulators have increased scrutiny on:

- Router and firmware management (including patching and version control)

- Third-party and remote access governance

- Asset visibility for edge devices and unmanaged connections

- Network separation and zero-trust architecture

Loxada is designed to support these priorities directly, providing a centrally controlled, pre-secured connection point that can be deployed anywhere staff work.

Why Community Banks Choose Loxada

Small banks no longer have to choose between complexity and compliance. Loxada elevates your institution’s security baseline at the uncontrolled network edge without disrupting operations or adding user friction.

Whether your staff are in branches, working from home, or moving between locations, Loxada provides them and your IT team with a secure, trusted path to your systems and data.

- Secures remote access with bank-grade encryption

- Improves compliance posture for FDIC, OCC, and state regulators

- Avoids reliance on user patching or configuration

- Reduces lateral risk from untrusted local devices

- Ideal for under-resourced IT teams in small banks

- Deploys in minutes and scales across distributed locations